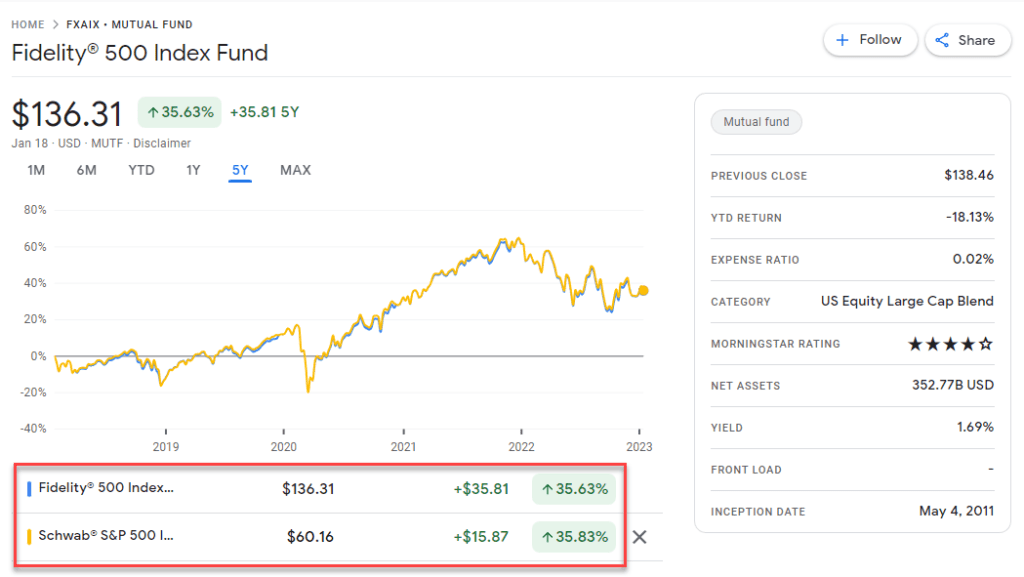

Spy is the oldest and one of the largest etfs tracking. Long term factor investing may actually favor those additional companies. Learn the pros and cons of investing in fxaix and swppx, two mutual funds that track the s&p 500 index.

FXAIX Vs. SWPPX Which Fund Is Better In 2023?

If sp500 goes up 20% you’ll have $120 in both accounts.

Fxaix has more cash in the.

Fxaix is a mutual fund. If this is a tax advantaged account (like an ira), i’d go with the mutual fund because you can set up automatic investing and don’t have to worry about it. The conclusion is fxaix is a strongbuy and swppx is a strongbuy. If you opt for the sp500 mutual fund, pick swppx.

The conclusion is fxaix is a strongbuy and swppx is a strongbuy. Find out their expense ratios, diversification, tax efficiency, and market risk. They both invest in the same index but the fidelity version’s fees are marginally cheaper. Its performance closely mirrors that of the s&p 500 index.

It’s as simple as that.

I wouldn’t worry too much about the price per share of the funds. Swtsx would add coverage of the rest of the us market, but finding an extended market only fund could be better (s&p 500 + extended market in the right ratio = us total market). Fidelity® 500 index fund ($fxaix) and schwab® s&p 500 index fund ($swppx). One would expect the fund with the lowest expense ratio to perform better, right?

In this article, we will delve into the key differences and similarities between swppx and fxaix, shedding light on their nuances and helping you make more informed trading choices. If you put $100 into fxaix (less than half a share), and $100 into swppx (more than one share), they will grow exactly the same. A detailed comparison of two mutual funds that invest in us stocks: The only thing cheaper is fnilx, but it's not technically a s&p 500 fund and it's not ideal for taxable accounts.

Fxaix and vfiax will cost you $75 to buy.

Well, check a comparison chart of these four and let me know your thoughts, please. It's cheaper than basically everything else (same price as ivv).