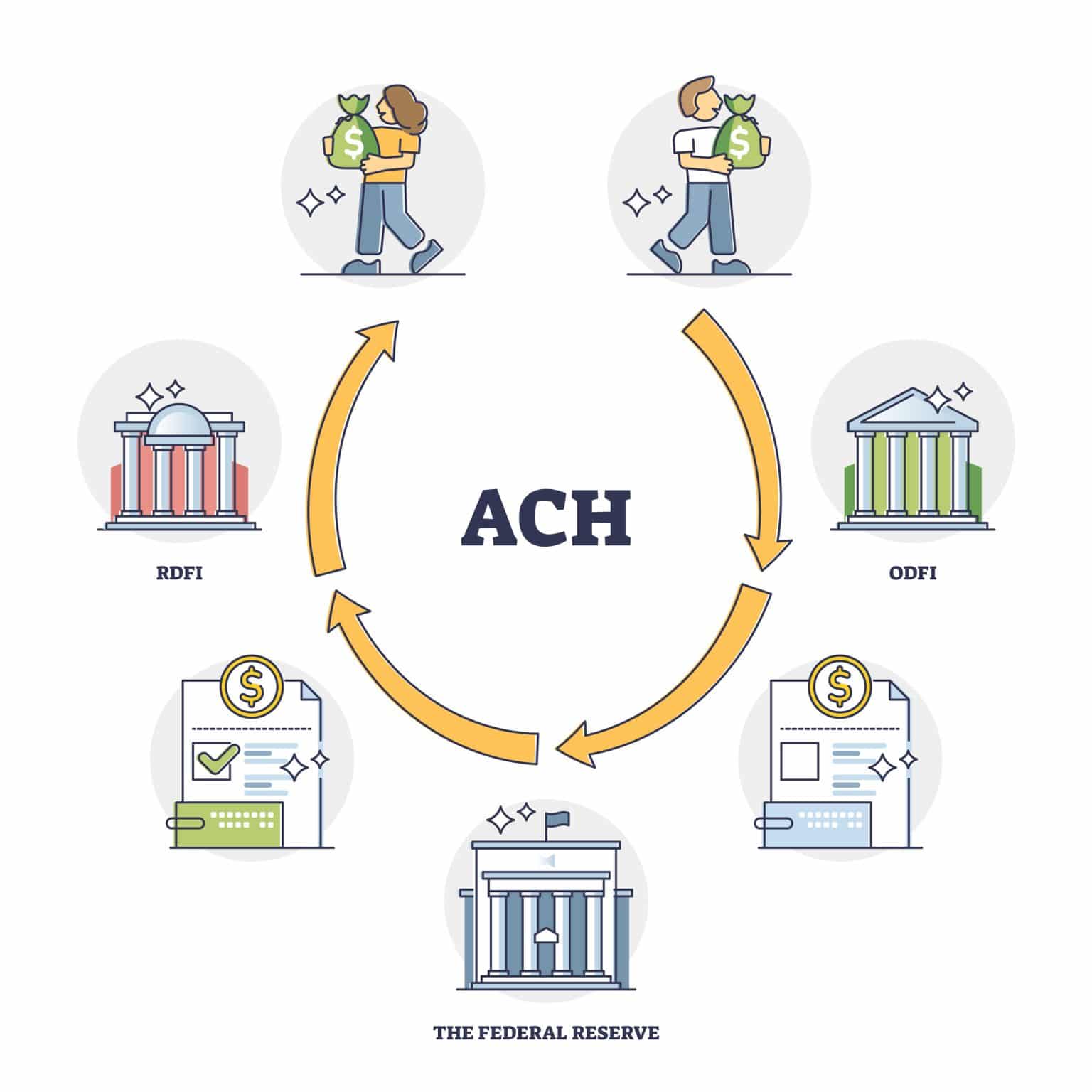

Ach payments are electronic transfers that are regulated by the national automated clearing house association, or nacha. When an ach return occurs, the funds are returned to the original account, and the transaction is canceled. There was plenty of funds in the account at the time and a separate payment has already gone through for the same card, so.

Ultimate Guide to ACH Payment Processing 5 Star Processing

Identify the reason for return.

When an ach payment gets rejected, the ach network gives you a rejection code or return code to explain why.

When your ach payment is returned, it’s essential to act quickly to resolve the issue. When these payments are made via. Ach payments use the bank routing number and customer’s. To verify whether an ach payment was returned, follow these steps:

Ach payments apply to checking and savings accounts and include direct deposits and recurring payments. Nacha, originally the national automated clearinghouse association, oversees and. Automated clearing house (ach) transactions are crucial for the smooth operation of financial processes such as payroll, direct deposits, and bill payments. By understanding these key aspects of ach payments, businesses can effectively navigate such scenarios and safeguard against potential financial losses.

Follow these steps to get things back on track:

Today's the 23rd and the payment was made on the 16th. Ach payments are electronic payments made through the automated clearing house network, a secure system that connects all u.s.